COVID-19 Business Interruption Insurance Litigation by the Numbers: Major Takeaways and Trends for 2022

Last updated on: January 5, 2022

Since the start of the pandemic, SDV has actively tracked nationwide lawsuits filed by policyholders against their insurers for coverage of COVID-19-related losses. After nearly two years and thousands of lawsuits, SDV has created the below on the status of COVID-19 business interruption litigation, including insights into the courts' decisions, with an eye toward future trends.

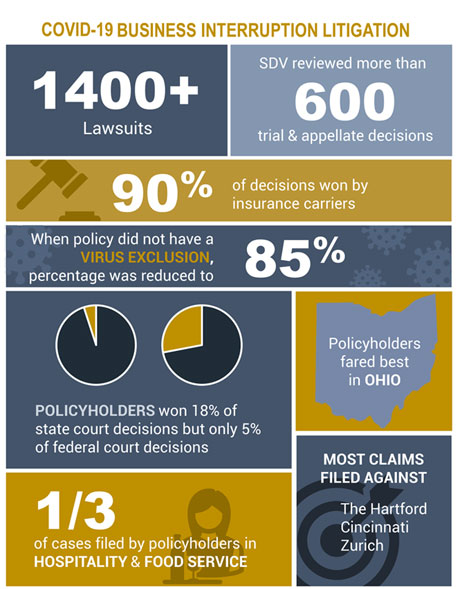

According to SDV's COVID-19 Insurance Coverage Litigation Tracker, over 1,400 lawsuits have been filed since March 2020 in state and federal courts. During this time, SDV reviewed and analyzed over 600 trial and appellate court decisions and observed the following:

- Federal courts have issued more decisions than state courts, around 70% and 30%, respectively.

- Carriers won in over 90% of the cases.

- Policyholders are more likely to prevail in cases without virus exclusions, with carriers winning 85% of the time.

- Policyholders have been more successful in state court than federal court. Insurers have won in around 95% of the cases decided in federal court and 72% of the cases decided in state court.

- Appeals have been filed in over 300 cases. Almost all were filed by insureds who had their cases dismissed. There are over 230 appeals currently pending in federal courts and around 70 in state courts.

- 18 Appellate Court decisions have been released thus far, 15 of which were issued by federal circuit courts-the Second, Sixth, Eighth, Ninth, Tenth, and Eleventh Circuits-and 3 by state courts-2 in Ohio, and 1 in California. None of these decisions were favorable to policyholders.

- Certain jurisdictions have been more favorable to insureds, above all, the state of Ohio, where policyholders succeeded in 30% of the cases. Other favorable jurisdictions include the state of Washington, where policyholders won 13% of the cases, and the state of Oklahoma, in which the courts granted two policyholders' motions for summary judgment.

- Over one-third of the cases have been filed by businesses in the hospitality and food service industries.

- Two cases have gone to trial, in both instances resulting in a judgment in the insurer's favor.1

- The Hartford, Cincinnati Financial, and Zurich Insurance Group have the most business interruption claims filed against them, making up 26.1% of all cases combined.

By and large, the courts have focused on two central issues: 1. Whether the presence of the virus on an insured's property qualifies as a direct physical loss or damage, and 2. Whether a virus exclusion bars coverage for business interruption related to the COVID-19 pandemic.

Most courts have found that COVID-19 exposure does not constitute direct physical loss or damage because an insured must demonstrate "some physicality" to the loss or damage of property. However, some policyholders have successfully argued that the virus may physically alter the property on a microscopic level, and some courts have considered that fact pattern, if proven, sufficient to establish "physical loss" In these cases, "direct physical loss" was interpreted to mean "the act of losing possession" and "deprivation." For example, at least one court found that a policy's use of the disjunctive "or" between the terms "physical loss of" and "damage to property" meant that the drafters intended for the terms to be considered differently.

Courts have consistently found that virus exclusions, which concern damage caused by "any virus, bacterium, or other microorganisms," bar coverage for COVID-19 related losses. Due to the broad nature of these exclusions and their applicability to direct and indirect causes of loss, insureds were more successful when their policies did not contain a virus exclusion. Although courts usually consider these exclusions as "plain and unambiguous" in language, at least once a policyholder successfully argued that a virus is not unambiguously understood to be a "microorganism."

Although policyholders were not able to prevail in most recent cases, the landscape of COVID-19 business interruption litigation is not yet fully determined. The federal courts have been consistent in holding that the virus does not cause any direct physical loss. However, no state appellate level courts have yet issued a decision on this question.

A case that may shape future COVID-19 business interruption litigation is currently pending in the Ohio Supreme Court6 regarding whether COVID-19 exposure constitutes direct physical loss or damage to insured property. Because of the centrality of this issue, the court's decision will likely be influential in determining future trends not only in Ohio but also throughout the country. Despite trends currently favoring insurers, it will take years to fully resolve the issues associated with COVID-19 business interruption insurance litigation.

SDV remains at the forefront of policy interpretation issues and filed an Amicus Brief in November 2021 as an advocate for policyholders nationwide in the matter of 1 S.A.N.T., Inc. v. National Fire & Marine Insurance Company, 513 F.Supp.3d 623 (W.D.Pa. 2021) and the related consolidated cases. In its brief, SDV argued that recent COVID-19 decisions requiring structural loss or physical alteration to covered property threaten to upset coverage law that had been otherwise settled for over a generation. SDV is dedicated to ensuring that policyholder interests are represented and protected in connection with COVID-19 litigation. You can click here to learn more about our firm's Amicus Brief filing

This webpage was last updated on January 5, 2022. To find more current information regarding COVID-19 litigation, we recommend visiting the COVID Coverage Litigation Tracker on the University of Pennsylvania's website

435 Dismissed with Prejudice Rulings

61 Re-File Complaint Rulings

44 Moves Forward to Discovery Rulings

9 Policyholder Wins - Summary Judgment Granted

32 Carrier Wins - Summary Judgment Granted

Click on the state(s) below for more detail

State rulings exist

No coverage rulings

Disclaimer: This material is made available for general informational purposes only. The information provided in SDV's "Daily COVID-19 Update" is indicative only and non-exhaustive. Readers are advised to independently verify the information contained herein. This material is not intended to, and does not constitute, legal advice, nor is it intended to constitute a solicitation for the formation of an attorney- client relationship. Please note, SDV does not represent any parties mentioned within the "Active Cases" section of this update.

Disclaimer: This material is made available for general informational purposes only. The information provided in SDV's "Coverage Rulings by Insurance Group" is indicative only and non-exhaustive. Readers are advised to independently verify the information contained herein. This material is not intended to, and does not constitute, legal advice, nor is it intended to constitute a solicitation for the formation of an attorney-client relationship. Please note, SDV does not represent any parties mentioned within the "Coverage Rulings by Insurance Group" section of this update.

Posted on Tuesday, October 20, 2020

In Optical Services USA/JCI v. Franklin Mut. Ins. Co.,1 the New Jersey Superior Court denied the insurer's motion to dismiss the policyholders' COVID-19 coverage suit. The Plaintiffs in this case were optometrists' offices forced to close by New Jersey Governor Phil Murphy's Executive Order No. 107, which temporarily shut down non-essential businesses to help slow the spread of COVID-19 in New Jersey.

Posted on Tuesday, October 20, 2020

Posted on Tuesday, October 20, 2020